Evolution of traffic (I_10)

The evolution over the last three years of the total tonnes moved in the Port of Huelva, as well as the tonnes moved by generic groups of goods and the percentage of each of these groups over the total, is as follows:

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Tonnes moved | 32,145,663 | 30,085,963 | 31,110,070 |

| Developments | 4.86% | -6.41% | 3.40% |

| Liquid bulk | 24,871,239 | 22,655,157 | 23,852,916 |

| Liquids as a percentage of the total | 77.37% | 75.30% | 76.67% |

| Solid bulk | 5,711,606 | 5,671,421 | 5,293,079 |

| Representation of solids in the total | 17.77% | 18.85% | 17.01% |

| General Merchandise | 1,296,694 | 1,459,115 | 1,742,738 |

| Overall representation of the total | 4.03% | 4.85% | 5.60% |

| Others (fishing, victualling and inland traffic) | 266,124 | 300,269 | 221,223 |

| Representation others/total | 0.83% | 0.99% | 0.71% |

The Port of Huelva closed the financial year 2024 with a total port traffic volume of 31,110 million tonnes, equivalent to an increase of 3.4% with respect to the traffic in 2023.

The dominance of bulk cargo remains Port of Huelva’s traditional area of specialisation, although the continued strategy of diversification to other business segments is allowing its positioning to move closer to that of a global port with an increase in the participation of general cargo in all its forms, both conventional and containerised and roll-on/roll-off.

In relation to solid bulk traffic, a total of 5.2 million tonnes were handled, a decrease of 6.67% compared to the previous year. The volume of mineral concentrates, associated with the traditional copper mining and manufacturing activity in Huelva, fell by 180,000 tonnes compared to the 2023 financial year, representing a decrease of 8.27%. Most of these concentrates are made up of copper and zinc ores moved by companies such as Impala and Atlantic Copper. On the other hand, although the traffic of cereals, animal feed and fodder transited through Huelva’s docks during 2024 exceeded 1.7 million tonnes, it did not reach the more than 2 million tonnes moved during 2023. None of the most important solid bulks of the port of Huelva has grown in volume compared to 2023, except for cement, which exceeded 176,000 tonnes compared to 102,000 tonnes in 2023. However, the share of this commodity in total solids is only 3.3 per cent, so this increase does not manage to balance the significant decline in mineral concentrates and cereals.

Liquid bulk traffic exceeded 23.8 million tonnes and was the main contributor to the total volume growth achieved in 2024. The extraordinarily high volumes of crude oil and refined petroleum products moved during 2024 have offset losses of other important liquids such as liquefied natural gas. Now that the uncertainties resulting from the geopolitical instability caused by the war in Ukraine have been overcome, the MOEVE La Rábida refinery facilities have returned to normal refining activity levels and the unusual gas stockpiles at the ENAGÁS logistics terminal in Huelva have been abandoned. With this, the MOEVE refinery ended the 2024 financial year unloading 9.5 million tonnes of oil through its monobuoy, increasing by more than 1 million tonnes the figures for the previous year, thus accumulating a growth of more than 12.5%.

Vegetable fats and oils have also contributed to this growth of liquids in Huelva’s docks. With a growth of more than 33% compared to 2023, the DECAL and LIPIDOS SANTIGA facilities have grown in activity during 2024 and have provided an increase in tonnage of almost 300,000 tonnes in absolute value.

As for LNG, and although the Huelva docks continue to be a strategic point for unloading ENAGÁS, in 2024 they barely exceeded 2.5 million tonnes, a far cry from the 3.1 million tonnes of 2023, amounting to a decrease of 17.28%.

This is not the case for the evolution of general merchandise, whose positive performance during 2024 permitted an overall growth of close to 19.5%. Iron scrap, metal and steel products in general, which ended 2024 with increases of 118%, 40% and 17% respectively, contributed particularly to this result.

Container traffic continues the upward trend of recent years and closed 2024 with a total movement of 107,166 TEUs, representing a growth of more than 20% compared to 2023.

As for Ro-Ro, Ro-Pax traffic, the year 2024 will end with a lower level of activity than the previous year. Due to the departure, in the month of April, of the regular Armas-Trasmediterránea line connecting the port of Huelva to the Canary Islands, a total of 30,613 ILUs were operated. This has meant a decrease of 10% with respect to the 2023 financial year.

Despite the loss of the Naviera Armas line in 2024, the Port of Huelva continues to occupy a prominent position in the Spanish Port System in terms of connectivity with the Canary Islands, as it continues to have a total of four weekly connections.

According to these figures, the Port of Huelva’s commitment to diversifying its activity as an intermodal and logistics port is bearing fruit in the growth of conventional and containerised general cargo, all of which is concentrated at the Muelle Sur intermodal platform. In support of this diversification objective, quality services for containerised cargo will continue to be provided during 2024 through the Huelva-Casablanca-Spanish Mediterranean connection, as well as the already consolidated Huelva-Northern Europe connection (United Kingdom, Holland and Germany).

The Port of Huelva closed the financial year with a total port traffic volume of 31,110 million tonnes, equivalent to an increase of 3.4%.

As for the Spanish Port System, made up of 28 Port Authorities, it closed the year 2024 with an average growth in goods of 2.7% compared to 2023. With this, the port of Huelva is positioned as the eighth largest port in Spain in terms of volume of goods handled. Likewise, in terms of liquid bulk traffic, the system as a whole grew by 2.3% with respect to 2023, compared to the greater increase in the Port of Huelva, which increased this volume by 5.29%. For this reason, the Port of Huelva retains third place in the national ranking for volume of liquids, only surpassed by the port of Algeciras and the port of Cartagena.

With regard to regular passenger services to the Canary Islands, there has been a significant drop of more than 19%, due to the loss in April of one of the connections to the archipelago, specifically the one operated by Naviera Armas.

As the number of connections on Route 1400 Huelva-Canarias has been reduced, there have also been decreases in the movement of goods vehicles (-28.5%) and in Intermodal Transport Units (ITUs), with a loss of 10%.

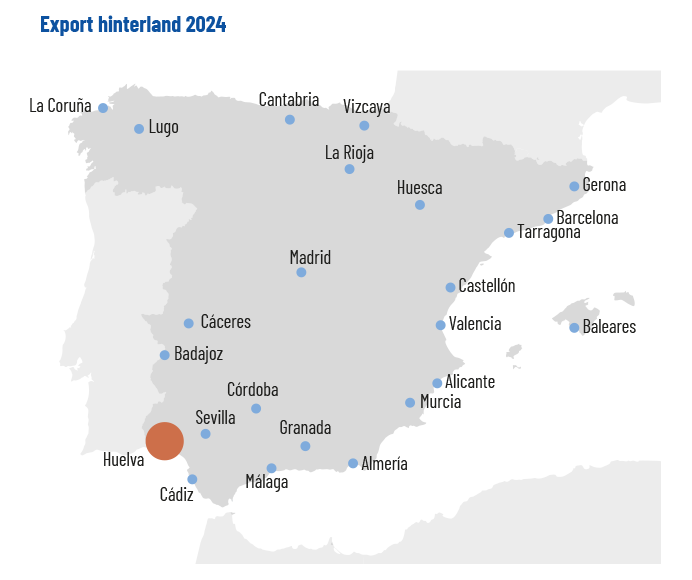

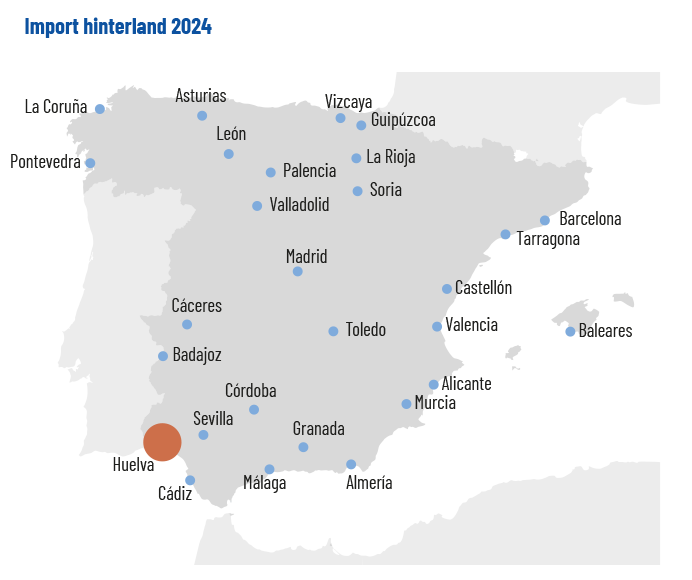

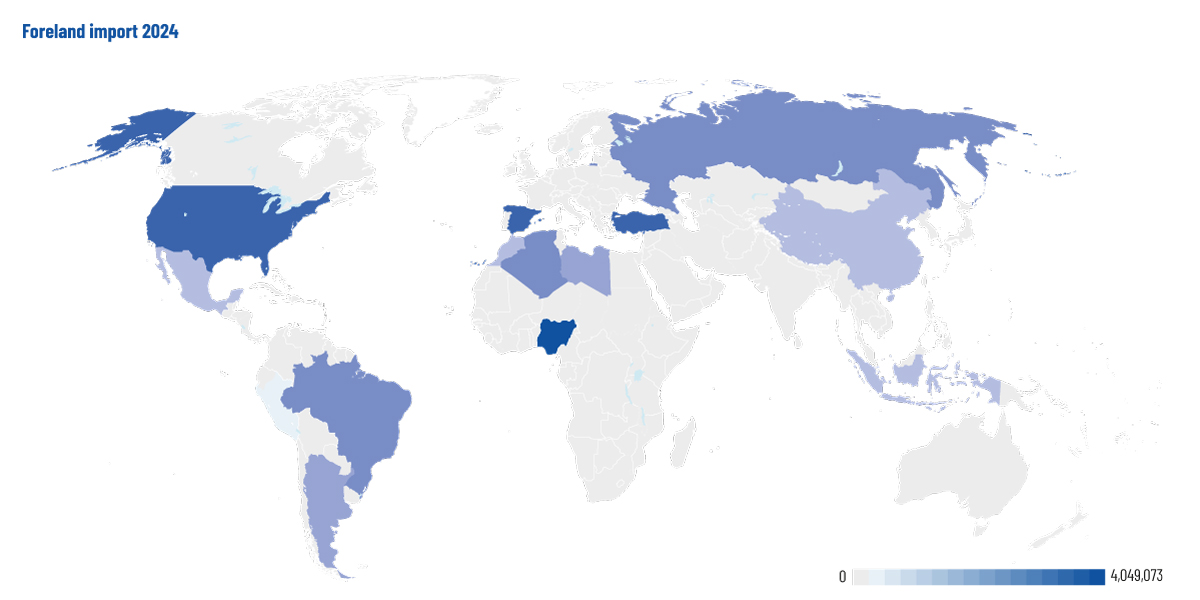

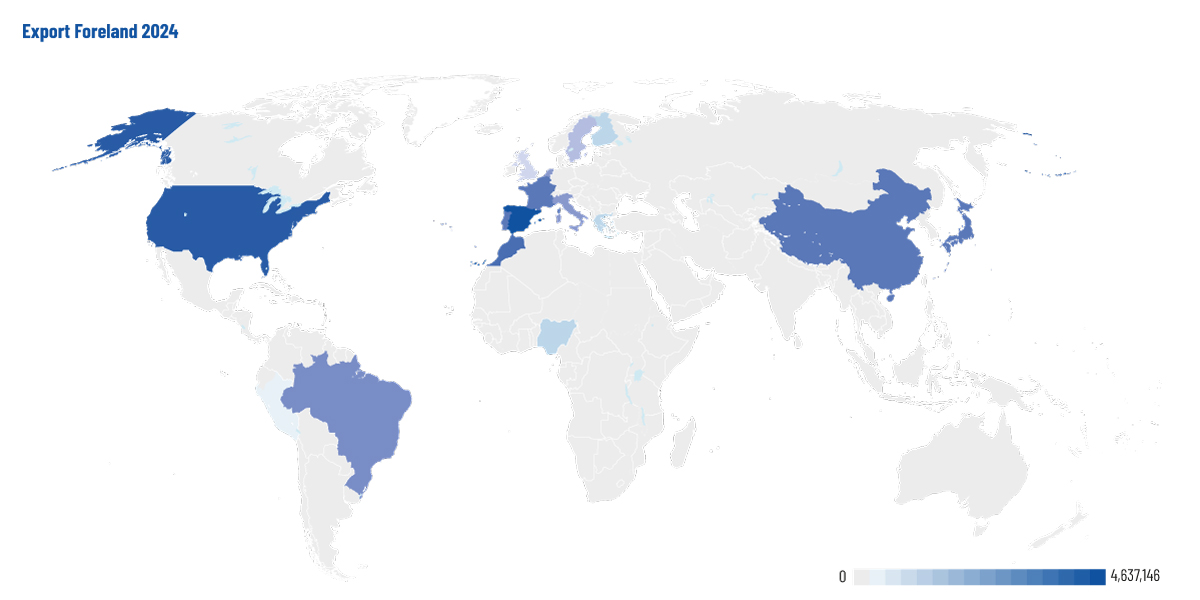

Hinterland and foreland. Main origins and destinations of goods (I_11)

The extension of the foreland, or the set of areas from which imports are attracted and exports are distributed in the Port of Huelva, is of note, due to the different countries of origin of the goods necessary for the industry.

The import and export foreland is identified below, with the main origins and destinations of the goods.

| Import Foreland 2024 | |

|---|---|

| Nigeria | 4,049,073 |

| Usa | 3,734,747 |

| Spain | 1,307,334 |

| Algeria | 1,203,623 |

| Brazil | 1,146,488 |

| Mexico | 654,074 |

| Ukraine | 584,031 |

| Russia | 511,535 |

| Indonesia | 479,065 |

| Libya | 451,073 |

| Guinea Ecua. | 449,290 |

| Holland | 441,707 |

| Angola | 402,066 |

| Peru | 386,826 |

| Malaysia | 364,667 |

| Export Foreland 2024 | |

|---|---|

| Spain | 4,637,146 |

| Usa | 1,163,044 |

| Morocco | 727,134 |

| China | 624,238 |

| Portugal | 531,394 |

| Belgium | 493,513 |

| France | 461,445 |

| Brazil | 403,466 |

| Italy | 388,196 |

| Holland | 275,938 |

| Sweden | 234,805 |

| Greece | 198,566 |

| Nigeria | 167,530 |

| Gibraltar | 152,157 |

| Finland | 149,368 |

Turnover invoiced to top five customers (I_12)

Out of a total invoiced in 2024 of 47,363,989.86 euros, the amounts invoiced to the five main customers amount to 21,748,541 euros, 45.92% of the total.

| Invoiced amount | % invoiced/total | |

|---|---|---|

| Total turnover | 47,363,989.86 | |

| Top five customers | 21,748,541 | 45.92% |

The top five customers are:

| Companies | Invoiced amount | % of total |

|---|---|---|

| Cia. Española de Petróleos S.A. CEPSA | 9,092,568 | 19.20% |

| Enagás Transporte S.A.U. | 3,832,489 | 8.09% |

| Ership S.A.U. | 3,283,902 | 6.93% |

| Erhardt Shipping Services, S.L. | 2,797,737 | 5.91% |

| Atlantic Copper S.L.U. | 2,741,846 | 5.79% |

Main sectors in economic development that rely on the port for their development (I_13)

The main sectors in which the companies of the Port Community carry out their activity are:

Industrial sector

a) Energy: Cepsa refinery (Moeve), Enagás regasification plant, Magnon biomass plant, biofuel plants such as Bio-oils and Gunvor, etc.

b) Metallurgical: copper cathodes leave the Muelle Ingeniero Juan Gonzalo from the Atlantic Copper smelter.

c) Chemical: with plants such as Cepsa Química, Fertiberia, Venator, Fertinagro, Electro Química Onubense, etc.

d) Mining: minerals enter the Muelle Ingeniero Juan Gonzalo, mainly copper concentrate for Atlantic Copper.

Logistics sector

a) Hydrocabides: Decal España, Exolum, Repsol.

b) Minerals: Impala Terminals.

c) Regular maritime lines with Northern Europe, the Canary Islands, Morocco and the Spanish Levante: CMA-CGM, Alisios Shipping, Balearia&FredOlsen and MCI.

Fishing sector

With an auction market for first sales and a wholesale market.

Cruise tourism sector

Cruise tourism has been reactivated, and in 2024 there were 14 stopovers of small cruise ships at the Muelle de Levante.

In addition to those related to commercial and port activities and services, such as: container terminals, shipping companies, stevedoring, customs agencies, shipping agents, freight forwarders, bunkering, provisioning, ship repairs, storage, etc.

Cruise tourism has been reactivated, and in 2024 there were 14 stopovers of small cruise ships at the Muelle de Levante.